Compliance, Investigations and Anti-Bribery

Guarantee FCPA compliance, mitigate risks, and conduct thorough due diligence with customized solutions and comprehensive investigation support from a global perspective.

Compliance, Investigations and Anti-Bribery Practice Group

TransPerfect Legal is a recognized leader in supporting white collar defense investigations, enforcement proceedings, and litigation, including under the U.S. Foreign Corrupt Practices Act (FCPA), UK Bribery Act (UKBA), and similar anti-bribery laws.

Compliance, Investigations and Anti-Bribery

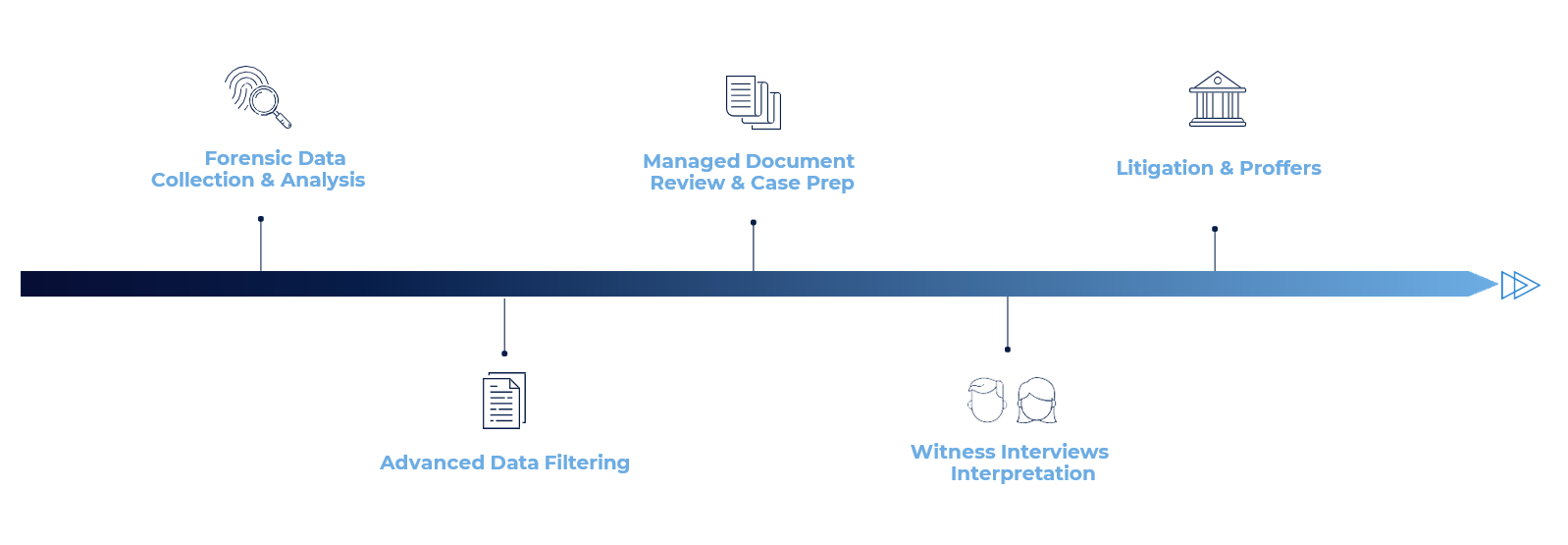

The Compliance, Investigations and Anti-Bribery Practice Group offers unparalleled value across the lifecycle of an FCPA investigation and compliance program.

Safeguard Your Enterprise with FCPA Guidance and Protection

The TransPerfect Legal Compliance, Investigations and Anti-Bribery Practice Group is uniquely positioned to reduce the time and burden of FCPA investigations and compliance programs by over 40% due to the following reasons.

1. Global Subject Matter Experts

From seasoned government investigators to former “big law” white collar defense attorneys, our experts in Compliance, Investigations and Anti-Bribery bring extensive experience to support your needs across jurisdictions and white collar practice areas. Backed by a global team of computer forensics experts, eDiscovery technologists, and managed review specialists, TransPerfect Legal stands ready to enhance your legal team with subject matter expertise seamlessly integrated as an extension of your personnel.

2. Cutting-Edge Investigative Technology

TransPerfect Legal’s white collar professionals leverage a robust technology stack to provide you with an efficient data investigation that yields accurate results. Our investigative technology includes an array of data processing, searching, analytics, and artificial intelligence tools so we can offer the breadth and depth to support our clients’ global investigations. Because each tool is only as useful as the person “driving” it, TransPerfect’s expert technologists are ever-ready to help identify, design, and execute the most streamlined and defensible workflows on a matter-by-matter basis.

TransPerfect’s Legal Technology Infrastructure

We can collect and analyze data remotely at a client location anywhere in the world, on-site, or in one of our digital forensic labs: Amsterdam, Atlanta, Boston, Chicago, Dallas, Dubai, Hong Kong, London, Los Angeles, Miami, New York, Newport Beach, Philadelphia, San Francisco, Sydney, Toronto, Washington, D.C.

In total, TransPerfect Legal has supported over 300 witness interviews, both in person and remotely, including across the Middle East, Europe, and South America. Further, TransPerfect has translated over 150,000 words in seven languages from the Americas, Europe, the Middle East, and Asia.

EU Whistleblower Directive: Using Technology to Streamline Compliance

In 2019, the EU Whistleblower Protection Directive was issued, providing comprehensive protection for whistleblowers who report violations of EU law. The directive will impact hundreds of thousands of companies across Europe that employ more than 50 people.

Many international companies are now faced with the challenge of implementing reporting options and investigation teams for multilingual staff. This includes translating new or updated policies, training employees, and handling investigations that have documents in multiple languages.

3. Multi-Language Support

In Compliance, Investigations and Anti-Bribery matters, especially those falling under the purview of the FCPA, Bribery Act, or similar legislation, the involvement of custodians and data sources from a variety of jurisdictions communicating in multiple languages is common.

As the foremost provider of language services in the legal sector, TransPerfect Legal delivers unparalleled value, offering a comprehensive suite of services tailored for multi-language data challenges: